HealthPartners Open Access Choice With Deductible

Navigating the healthcare landscape can often feel like traversing a complex maze. With a plethora of plans and coverage options available, making an informed decision that aligns with your individual needs and financial circumstances is paramount. Many factors come into play, including the size of your family, your typical healthcare utilization, and your risk tolerance. Understanding the nuances of each plan type is essential to ensure you have access to the care you need while managing costs effectively.

Choosing the right health insurance plan is a critical decision that can significantly impact your well-being and financial security. A comprehensive understanding of different plan types, such as HMOs, PPOs, and plans with deductibles, is the first step towards making an informed choice. You should consider the trade-offs between monthly premiums, out-of-pocket costs, and the flexibility to choose your healthcare providers.

One of the common questions people ask when selecting a health insurance plan is, "What is a deductible, and how does it work?" A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance plan begins to pay. Understanding how deductibles, copays, and coinsurance work together is crucial for budgeting and preparing for healthcare expenses. Each plan is designed to strike a different balance between monthly payments and out-of-pocket expenses.

In recent years, high-deductible health plans have gained popularity due to their lower monthly premiums, but it's essential to evaluate whether these plans are the right fit for your healthcare needs. If you anticipate needing frequent medical care, a plan with a lower deductible might be more suitable, even if it comes with a higher monthly premium. On the other hand, if you're generally healthy and don't expect to use your insurance often, a high-deductible plan could be a cost-effective option.

Within the array of choices, plans like **HealthPartners Open Access Choice with Deductible** are specifically designed to offer a balance of flexibility and cost control. Understanding the specific features and benefits of this plan can help you determine if it aligns with your personal healthcare needs and budget.

Understanding the Basics of Open Access Choice with Deductible

What Does "Open Access" Mean?

The term "Open Access" in a health insurance plan typically refers to the freedom you have in choosing your healthcare providers. Unlike some HMO plans that require you to select a primary care physician (PCP) and obtain referrals to see specialists, an open access plan generally allows you to see specialists without a referral. This flexibility can be particularly beneficial for individuals who have specific medical needs or prefer to have direct access to specialists.

This access provides you with greater control over your healthcare decisions. You can choose to see any doctor or specialist within the plan's network, without needing to first consult with a primary care physician. This eliminates the need for referrals, saving you time and potential co-pays associated with PCP visits.

The open access feature is especially useful if you have pre-existing conditions that require ongoing care from specialists. It allows you to maintain your relationships with your preferred specialists without navigating referral processes. However, it's still important to verify that your chosen specialists are in-network to avoid higher out-of-pocket costs.

Some open access plans may encourage you to establish a relationship with a primary care physician to coordinate your care, even though it's not strictly required. Having a PCP can help ensure you receive comprehensive care and preventive services, but the choice is ultimately yours.

Open access plans provide greater autonomy over your medical care. You can seek specialist advice quickly and easily, without going through a primary care doctor first. This can be a significant advantage when dealing with complex medical issues or when you require specialized treatment.

The Role of the Deductible

The deductible is the amount of money you pay out-of-pocket for covered healthcare services before your health insurance plan starts to pay. This means that until you reach your deductible amount, you're responsible for paying the full cost of your medical bills, with the exception of certain preventive services that may be covered at no cost to you.

The deductible amount can vary significantly depending on the plan you choose. Some plans have lower deductibles, while others have higher deductibles. A lower deductible typically means you'll pay less out-of-pocket before your insurance kicks in, but it also often comes with a higher monthly premium. Conversely, a higher deductible usually results in a lower monthly premium, but you'll need to pay more out-of-pocket before your insurance starts to cover your medical expenses.

Understanding your deductible is crucial for budgeting for healthcare expenses. It's important to consider your typical healthcare utilization when selecting a plan with a deductible. If you anticipate needing frequent medical care, a plan with a lower deductible may be more financially advantageous. However, if you're generally healthy and don't expect to use your insurance often, a plan with a higher deductible could be a cost-effective choice.

Once you meet your deductible, your insurance plan will begin to pay for covered healthcare services. This typically involves copays or coinsurance, which are amounts you pay for each service after your deductible has been met. Copays are fixed amounts you pay for specific services, such as doctor's visits or prescription drugs, while coinsurance is a percentage of the cost of the service that you're responsible for paying.

The relationship between your deductible, copays, and coinsurance determines your overall out-of-pocket healthcare costs. It's important to carefully review the plan details to understand how these elements work together and to estimate your potential healthcare expenses.

Benefits of HealthPartners Open Access Choice with Deductible

Flexibility in Choosing Providers

One of the major benefits of **HealthPartners Open Access Choice with Deductible** is the flexibility it provides in choosing your healthcare providers. Unlike some managed care plans that restrict you to a specific network of doctors and hospitals, this plan allows you to see any provider, both in-network and out-of-network, although in-network providers will typically result in lower out-of-pocket costs.

This flexibility can be particularly appealing to individuals who have established relationships with specific doctors or specialists. You can continue to see your preferred providers without needing to change your healthcare arrangements. It also offers convenience for individuals who travel frequently or have family members living in different locations.

While you have the freedom to choose any provider, it's important to understand the cost implications of seeing out-of-network providers. Out-of-network providers may charge higher fees, and your insurance plan may cover a smaller percentage of the cost, resulting in higher out-of-pocket expenses for you. Therefore, it's always advisable to prioritize in-network providers whenever possible.

The ability to see specialists without a referral is another significant advantage of this plan. You can directly schedule appointments with specialists without needing to first consult with a primary care physician. This can save you time and money, and it can also expedite access to specialized care when you need it most.

The flexibility in choosing providers also extends to hospitals and other healthcare facilities. You can choose to receive care at any hospital or facility that accepts your insurance plan. This can be particularly important if you have a preference for a specific hospital or if you need to seek care in a different location.

Potential for Lower Premiums

Health plans with deductibles often come with lower monthly premiums compared to plans with no deductible or low deductible. This is because you are sharing more of the financial risk with the insurance company. By agreeing to pay a certain amount out-of-pocket before your insurance coverage kicks in, you are essentially reducing the insurance company's exposure to risk, which translates to lower monthly premiums for you.

The potential for lower premiums can be particularly attractive to individuals who are generally healthy and don't anticipate needing frequent medical care. If you don't expect to use your insurance often, you may find that a plan with a higher deductible is a more cost-effective option, as you'll be paying less in monthly premiums.

However, it's important to carefully consider your healthcare needs and potential medical expenses when selecting a plan with a deductible. If you have a chronic condition or anticipate needing frequent medical care, a plan with a lower deductible may be more financially advantageous, even if it comes with a higher monthly premium.

The savings on monthly premiums can be significant over the course of a year, especially for individuals who are relatively healthy. These savings can be used to cover other expenses or invested for the future. However, it's crucial to have enough savings to cover your deductible in case you do need medical care.

When comparing different health insurance plans, it's essential to look beyond just the monthly premium. Consider the deductible, copays, coinsurance, and out-of-pocket maximum to get a complete picture of your potential healthcare costs. A plan with a lower premium may not always be the most cost-effective option if it comes with a high deductible and other out-of-pocket expenses.

Key Considerations Before Choosing This Plan

Assessing Your Healthcare Needs

Before deciding if **HealthPartners Open Access Choice with Deductible** is right for you, it's crucial to assess your individual healthcare needs. Think about how often you typically visit the doctor, whether you have any chronic conditions that require ongoing care, and if you anticipate needing any major medical procedures in the near future. This will help you estimate your potential healthcare expenses and determine if a plan with a deductible is a good fit.

Consider your family's healthcare needs as well. If you have children or other dependents who require frequent medical care, a plan with a lower deductible might be more suitable. On the other hand, if you're a young, healthy individual with no pre-existing conditions, a plan with a higher deductible could be a more cost-effective option.

Take into account any specific medical needs you may have, such as prescription medications or mental health services. Check the plan's formulary to see if your medications are covered, and inquire about coverage for mental health services if you require them. It's also important to understand the plan's policies on pre-existing conditions and how they may affect your coverage.

If you're unsure about your healthcare needs, consider consulting with a healthcare professional or a benefits advisor. They can help you assess your risk factors and provide personalized recommendations based on your individual circumstances. They can also help you understand the different types of health insurance plans and their respective advantages and disadvantages.

Accurately assessing your healthcare needs is essential for making an informed decision about your health insurance coverage. By taking the time to evaluate your potential medical expenses, you can choose a plan that provides adequate coverage while managing your costs effectively.

Understanding the Network

While HealthPartners Open Access Choice with Deductible offers flexibility in choosing your healthcare providers, it's still important to understand the plan's network. In-network providers have agreements with the insurance company to provide services at discounted rates. Seeing in-network providers typically results in lower out-of-pocket costs for you.

Before enrolling in the plan, check to see if your preferred doctors, specialists, and hospitals are in-network. You can usually find a provider directory on the insurance company's website or by contacting their customer service department. It's also a good idea to confirm with your providers directly that they participate in the plan's network.

If you see an out-of-network provider, you may be responsible for paying a higher percentage of the cost of the service. Out-of-network providers may also bill you for the difference between their charges and the amount the insurance company is willing to pay, which is known as balance billing. This can result in significant out-of-pocket expenses.

In some cases, you may need to seek care from an out-of-network provider, such as in an emergency situation or when you need specialized care that is not available in-network. In these situations, the insurance company may cover a portion of the cost, but you'll likely still be responsible for a higher amount than you would pay for in-network care.

Understanding the plan's network and the cost implications of seeing out-of-network providers is crucial for managing your healthcare expenses. By prioritizing in-network providers whenever possible, you can minimize your out-of-pocket costs and ensure that you receive the best possible care.

Comparing HealthPartners Open Access Choice with Other Plans

Open Access vs. HMO

When comparing HealthPartners Open Access Choice with Deductible to other health insurance plans, it's important to consider the differences between open access plans and HMOs (Health Maintenance Organizations). HMOs typically require you to select a primary care physician (PCP) who will coordinate your care and provide referrals to specialists. Open access plans, on the other hand, generally allow you to see specialists without a referral.

HMOs often have lower monthly premiums and lower out-of-pocket costs compared to open access plans. However, they also offer less flexibility in choosing your healthcare providers. You're typically limited to seeing providers within the HMO's network, and you may need to obtain a referral from your PCP before seeing a specialist.

Open access plans provide greater flexibility in choosing your healthcare providers, but they may come with higher monthly premiums and higher out-of-pocket costs. You can see any provider, both in-network and out-of-network, although in-network providers will typically result in lower costs. You can also see specialists without a referral, which can save you time and money.

The best choice between an open access plan and an HMO depends on your individual healthcare needs and preferences. If you prioritize flexibility and direct access to specialists, an open access plan may be a good fit. However, if you're looking for lower premiums and lower out-of-pocket costs, and you're comfortable with the referral process, an HMO may be a better option.

HealthPartners offers both open access and HMO plans, so you can choose the plan that best meets your needs. It's important to carefully compare the features and benefits of each plan before making a decision.

Considering PPO Options

PPOs (Preferred Provider Organizations) are another type of health insurance plan that offers a balance of flexibility and cost control. Like open access plans, PPOs allow you to see any provider, both in-network and out-of-network. However, PPOs typically have a larger network of providers than open access plans.

PPOs also have a tiered cost structure. You'll typically pay less for seeing in-network providers than for seeing out-of-network providers. However, you don't need a referral to see a specialist, even if they are out-of-network.

HealthPartners Open Access Choice with Deductible offers similar flexibility to a PPO in that you can see any provider you choose. The main difference lies in the cost structure and the size of the network. It's essential to compare the specific details of each plan to determine which one best suits your needs and budget.

When comparing PPO options with HealthPartners Open Access Choice with Deductible, consider factors such as monthly premiums, deductibles, copays, coinsurance, and the size of the provider network. Also, think about your healthcare utilization and whether you prefer the freedom to see any provider or the potential for lower costs with in-network care.

Ultimately, the best choice depends on your individual circumstances and preferences. By carefully evaluating the features and benefits of each plan, you can make an informed decision that provides the coverage you need at a price you can afford.

Tips for Managing Healthcare Costs with This Plan

Utilizing Preventive Care Services

One of the best ways to manage healthcare costs with **HealthPartners Open Access Choice with Deductible** is to take advantage of preventive care services. Many preventive services, such as annual checkups, vaccinations, and screenings, are covered at no cost to you, even before you meet your deductible.

Preventive care services can help you stay healthy and detect potential health problems early on, when they are often easier and less expensive to treat. By getting regular checkups and screenings, you can reduce your risk of developing serious illnesses and avoid costly medical treatments in the future.

Make sure to schedule your annual checkup and any recommended screenings with your doctor. Ask your doctor about any preventive services that are appropriate for your age, gender, and health history. Taking advantage of these services can help you stay healthy and save money on healthcare costs in the long run.

In addition to preventive care services, consider adopting healthy lifestyle habits, such as eating a balanced diet, exercising regularly, and avoiding tobacco and excessive alcohol consumption. These habits can help you maintain your health and reduce your risk of developing chronic diseases.

Taking proactive steps to manage your health can not only save you money on healthcare costs but also improve your overall well-being and quality of life.

Considering Telehealth Options

Telehealth services are a convenient and cost-effective way to access healthcare from the comfort of your own home. Many health insurance plans, including HealthPartners Open Access Choice with Deductible, offer telehealth services for a variety of medical conditions.

Telehealth allows you to consult with a doctor or other healthcare provider remotely, using your computer, smartphone, or tablet. You can receive medical advice, diagnoses, and prescriptions through telehealth, without having to travel to a doctor's office. This can save you time and money, especially if you live in a rural area or have difficulty getting to a doctor's office.

Telehealth services are often less expensive than in-person doctor's visits. You may only need to pay a copay for a telehealth visit, and you can avoid the costs of transportation and parking. Telehealth can also be a convenient option for routine medical care, such as prescription refills and follow-up appointments.

Check with your insurance plan to see what telehealth services are covered. You may be able to access telehealth services through your insurance company's website or app. Telehealth is a valuable tool for managing your healthcare costs and accessing convenient medical care.

Consider exploring telehealth options whenever appropriate for routine check ups or minor medical issues. This can help you save both time and money while receiving quality care.

Making the Final Decision: Is It Right for You?

Weighing the Pros and Cons

Deciding whether **HealthPartners Open Access Choice with Deductible** is the right health insurance plan for you requires careful consideration of the pros and cons. This plan offers flexibility in choosing your healthcare providers and potential for lower premiums. However, it also comes with a deductible that you'll need to meet before your insurance coverage kicks in.

Weigh the benefits of flexibility and lower premiums against the potential for higher out-of-pocket costs if you need frequent medical care. Consider your healthcare needs, your budget, and your risk tolerance. If you're generally healthy and don't expect to use your insurance often, this plan may be a good fit. However, if you have a chronic condition or anticipate needing frequent medical care, a plan with a lower deductible may be more financially advantageous.

It's also important to consider the network of providers and the cost implications of seeing out-of-network providers. If you have preferred doctors or specialists, make sure they are in-network. If you're willing to prioritize in-network providers, you can minimize your out-of-pocket costs.

Take the time to compare this plan with other health insurance options and carefully evaluate the features and benefits of each plan. Consider factors such as monthly premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. By thoroughly assessing your needs and comparing your options, you can make an informed decision that provides the coverage you need at a price you can afford.

The ultimate decision should be based on what works best for your individual circumstances and healthcare needs. Don't hesitate to seek advice from a benefits advisor or healthcare professional if you need help making a decision.

Reviewing the Summary of Benefits and Coverage

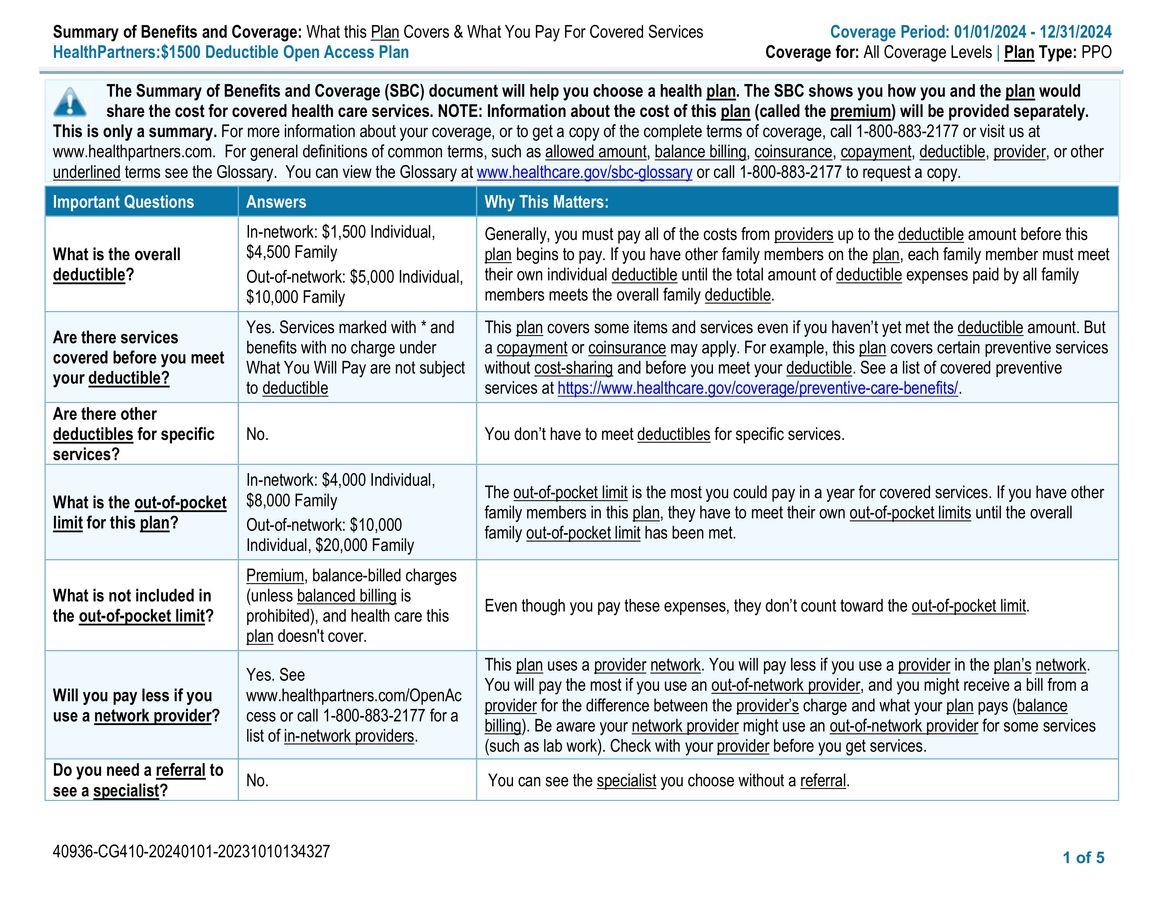

Before finalizing your decision, it's essential to review the Summary of Benefits and Coverage (SBC) document for HealthPartners Open Access Choice with Deductible. The SBC provides a concise overview of the plan's key features, including covered services, cost-sharing amounts, and exclusions. This document is designed to help you compare different health insurance plans and make an informed decision.

The SBC will outline the deductible, copays, and coinsurance amounts for various healthcare services. It will also provide information about the plan's out-of-pocket maximum, which is the most you'll pay for covered services in a plan year. Carefully review these cost-sharing amounts to understand your potential financial responsibility.

The SBC will also list the covered services, such as doctor's visits, hospital care, prescription drugs, and mental health services. Check to see if the services you need are covered, and understand any limitations or exclusions that may apply.

Pay close attention to the section on preventive care services, as many of these services are covered at no cost to you. Also, review the section on emergency care to understand how the plan covers emergency services, both in-network and out-of-network.

The SBC is a valuable resource for understanding the details of your health insurance plan. By carefully reviewing this document, you can ensure that the plan meets your needs and that you're aware of your potential healthcare costs.

Conclusion

Choosing the right health insurance plan is a personal decision that requires careful consideration of your individual healthcare needs, budget, and preferences. **HealthPartners Open Access Choice with Deductible** offers flexibility in choosing your healthcare providers and potential for lower premiums, but it also comes with a deductible that you'll need to meet before your insurance coverage kicks in.

Remember to weigh the pros and cons, assess your healthcare needs, understand the plan's network, and compare it with other health insurance options. By taking the time to research and evaluate your options, you can make an informed decision that provides the coverage you need at a price you can afford.

If you found this article helpful, be sure to check out our other articles on health insurance, healthcare costs, and healthy living. We're committed to providing you with the information you need to make informed decisions about your health and well-being.

Stay informed, stay healthy, and make smart choices about your healthcare coverage.

- Open Access: See specialists without referrals.

- Deductible: Pay a set amount before insurance covers costs.

- Flexibility: Choose any provider, in or out-of-network.

- Lower Premiums: Potentially lower monthly payments.

- Preventive Care: Often covered at no cost, even before deductible.

- Telehealth: Access care remotely, potentially saving time and money.

- Summary of Benefits: Review details of coverage and costs.